The FTX saga continues with a lot of new and decidedly odd spinoffs.

One of the large dominos to fall after the FTX collapse was the Atomic Asset Exchange better known as AAX. Cointelegraph succinctly summarize here how the collapse of that exchange led to the arrest of two of its former top management with a third having fled to most likely Taiwan due to their lack of any extradition treaties anywhere.

However as usual with law enforcement action this has been too little too late. There were multiple other players in the know at AAX regarding the severity of their situation the majority of whom chose to leave the exchange rather fortuitously prior to the arrests.

There were however within that group of in the know people a core group who kept up operations in a business as usual manner and in the process managed to defraud at least two crypto projects out of listing fees that we are aware of.

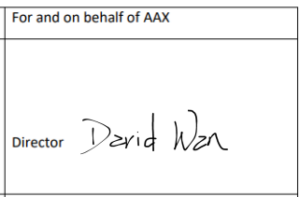

One of the major bad actors from the period leading into the collapse of FTX was David Wan AAX’s deputy COO and apparently director of exchange operations in the Seychelles, his team continued to collect listing fees from projects up till and into early December.

Working directly for him were a team of listings managers who also continued to aid fraudulent conduct, if in a somewhat less decisive manner.

Now we come to the crux of the matter, many of those in the know staff from the former AAX exchange are currently sitting pretty at other exchanges, BTCEX and Digifinex being the two most noteworthy from the range.

In BTCEX’s case they are currently employing at least on of the fraudulent listing managers in a similar position. Which should be a matter of grave concern to any projects considering working with them.

Why would an otherwise reputable exchange hire someone directly involved in multiple counts of fraud?

Well, we can only speculate but none of the answers we can come up with seem good or positive for BTCEX in any way shape of form.

Also of grave concern is Digifinex’s involvement with many staff having had dual roles at both exchanges as well as Digifinex’s COO having been a major stake holder in AXX for a considerable amount of time.

Have Digifinex divested themselves of all tainted staff? Why has there not been press releases from Digifinex concerning this issue and how it will affect their operations.

Their customers deserve answers to these questions and so do projects considering to list with them. We have reached out to Digifinex for comment on these issues but have as of yet not heard back from them.

It really is a sad day in crypto as it comes to light that in Hong Kong and Shenzhen and Turdeau’s Canada, it is all just business as usual despite deep involvement with illicit activities.

Comment was requested from both Digifinex and BTCEX on the 13th of Janurary and has of yet not been forthcoming.

Should you happen to like our work and want to tip us, we like:

XMR: 8BmXBq2KSs6is4L8W2TSHBFGPBLWGwnJ44J5p1PXQ1FPTEVh4PKdtoi5phNhA2mnxNKBqEGcgMtbf5Hk7giU5xxK6gr1MyA

Firo: aPwWaw5aacY2kCFMfVccqtsXiEHrxgpHpT